N O T I C E

N O T I C E

MSPbots WIKI is moving to a new home at support.mspbots.ai![]() to give you the best experience in browsing our Knowledge Base resources and addressing your concerns. Click here

to give you the best experience in browsing our Knowledge Base resources and addressing your concerns. Click here![]() for more info!

for more info!

N O T I C E

N O T I C E

MSPbots WIKI is moving to a new home at support.mspbots.ai![]() to give you the best experience in browsing our Knowledge Base resources and addressing your concerns. Click here

to give you the best experience in browsing our Knowledge Base resources and addressing your concerns. Click here![]() for more info!

for more info!

The MSP Finance Team Financial Metrics and Benchmarks Suite Dashboards feature reports for each identified Key Performance Indicator (KPI) and benchmarking widgets to compare your company's metrics against industry standards over a selected period. These highlight how your company's performance compares with the MSP industry's benchmarking categories. You can filter values in the dashboards and drill through most widgets for breakdowns and to show more details.

The MSP Finance Team Financial Metrics and Benchmarks Suite requires ConnectWise Manage, Quickbooks, and Xero integrations.

What's in this article:

MSPF Aggregated and Monthly Dashboards

The MSP Finance Team Financial Metrics and Benchmarks Suite dashboards use the Service Leadership Index (SLI) to calculate metrics and benchmarks. Data are presented in aggregated and monthly reports so you can get insights from different levels of detail according to the specific needs and goals of your organization.

MSPF SLI Mapping Aggregate Dashboard

The MSPF aggregated dashboards put together data across a longer time period, such as a quarter or a year, to show a general overview of performance. Aggregated dashboards are useful in identifying overall trends in performance over time and show if your company's performance has been improving or declining during this period.

Below are examples of MSPF Aggregated Dashboards

MSPF SLI Mapping by Month Dashboard

The MSPF monthly dashboards present data over months to identify and analyze trends and patterns in SLI performance during shorter time periods. These dashboards are useful for identifying seasonal or cyclical patterns in your company's performance. It highlights if performance is consistently better or worse during certain months of the year.

MSP Finance Team Financial Metrics Dashboard

This dashboard provides insights into your company's overall profitability and efficiency using data on Expenses, Revenue, Labor Hours, and Labor Costs. As a business owner or service manager, you have a bird's eye view of the company's financial performance. You can identify trends and issues that are important in making informed and timely decisions. You can filter this dashboard by date range and drill through most widgets to view the breakdown of calculations and more details.

Below are the available widgets in this dashboard.

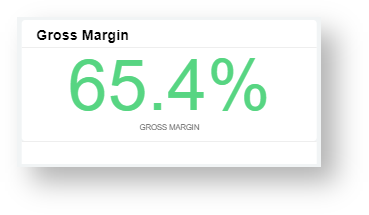

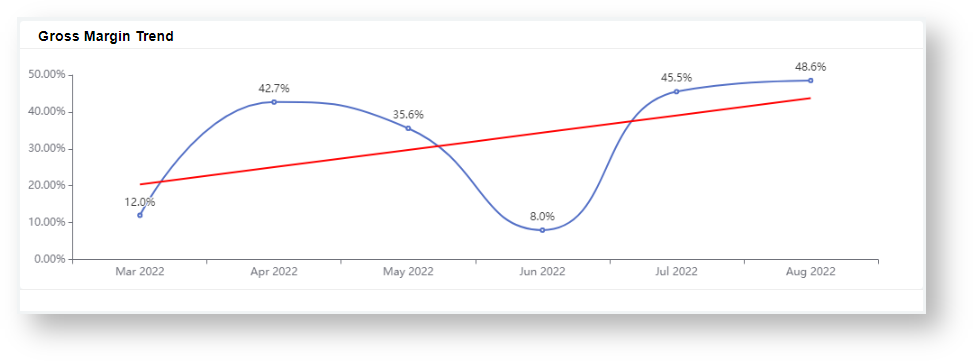

Gross Margin

The Gross Margin card number widget shows the overall gross margin for the selected date range and has a corresponding line graph that shows the trend of Gross Margin for the last 6 months.

Gross Margin is Revenue minus Cost of Goods Sold (COGS) expressed as a percentage of Revenue: Total Revenue - Total COGS) / Total Revenue.

Data source: Xero P&L (SLI-Mapped) - for Revenue, COGS

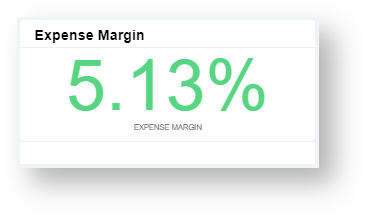

Expense Margin

The Expense Margin card number shows the overall expense margin for the selected date range. It is the ratio of Expenses and Revenue: Total Expenses / Total Revenue.

Data source: Xero P&L (SLI-Mapped) - for Revenue, Expenses

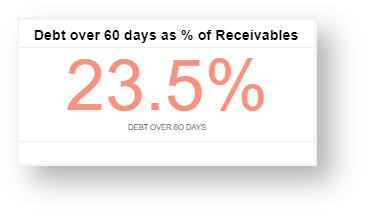

Debtor amount over 60 days as % of Receivables

The Debtor amount over 60 days as % of Receivables card number shows the total of debts aging for more than 60 days. The data shown on this widget adjusts according to the selected date range. The value is computed as the ratio of Overdue Invoices and all Aged Receivables: Total of Invoices aging over 60 days / Total Aged Receivables.

Data source: Xero Invoices - for Debt > 60 days, Total Aged Receivables

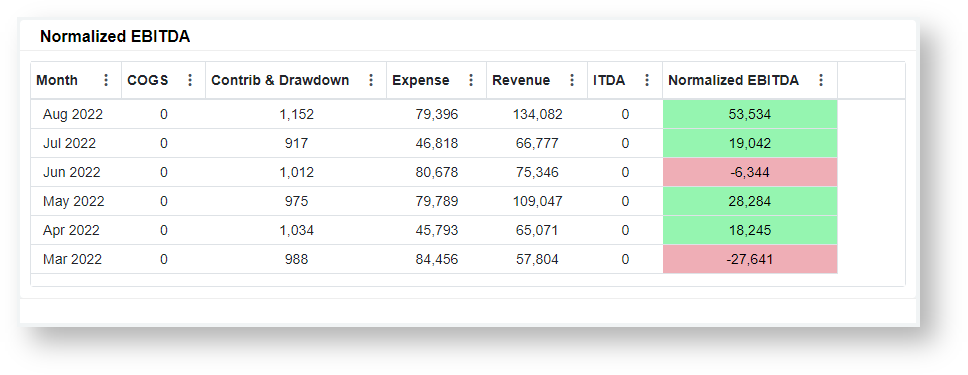

Normalized EBITDA

The Normalized EBITDA table shows Normalized Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) for the last 6 months. It is computed as the ratio of Overdue Invoices and all Aged Receivables: Revenue + ITDA - Expense - COGS - Contributions & Drawdown

Data sources:

- Xero P&L (SLI-Mapped) - for COGS, Expenses, Revenue, Interest, Taxes, Depreciation, Amortization

- Teams - for Contributions & Drawdowns

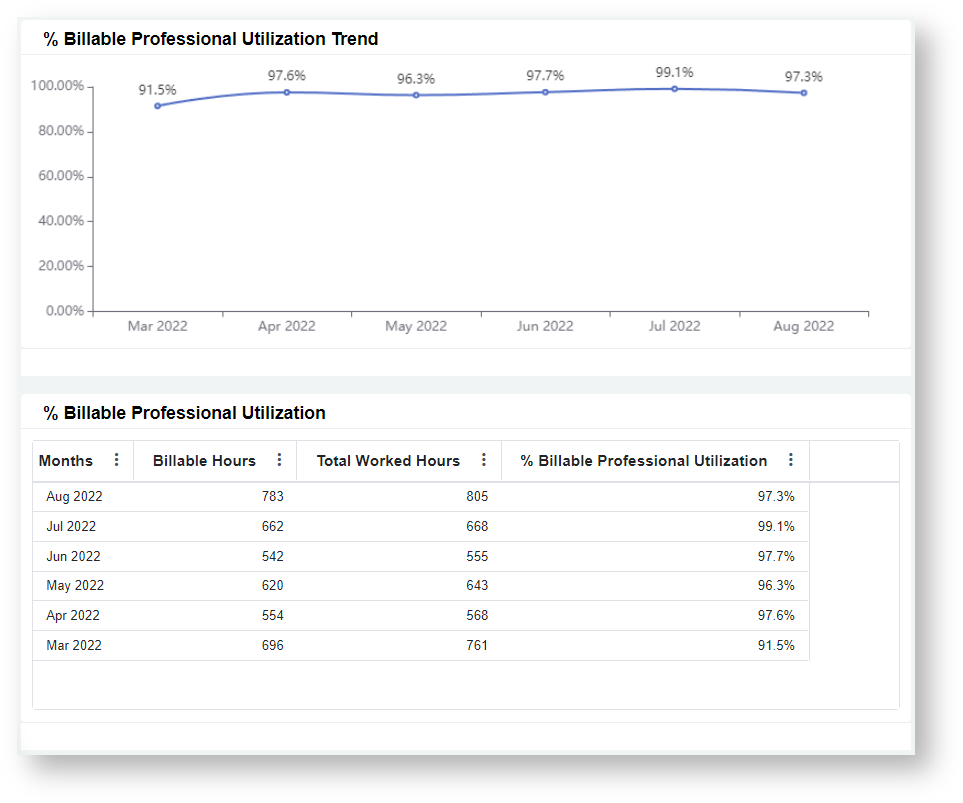

% Billable Professional Utilization

The % Billable Professional Utilization is a table and a line graph showing the percentage of Billable Professional Hours that are billable for the last 6 months. Its formula is Total Billable Hours / Total Worked Hours. Total Worked Hours is the total logged hours.

Data source: ConnectWise Manage Time Entries - for Billable Hours, Worked Hours

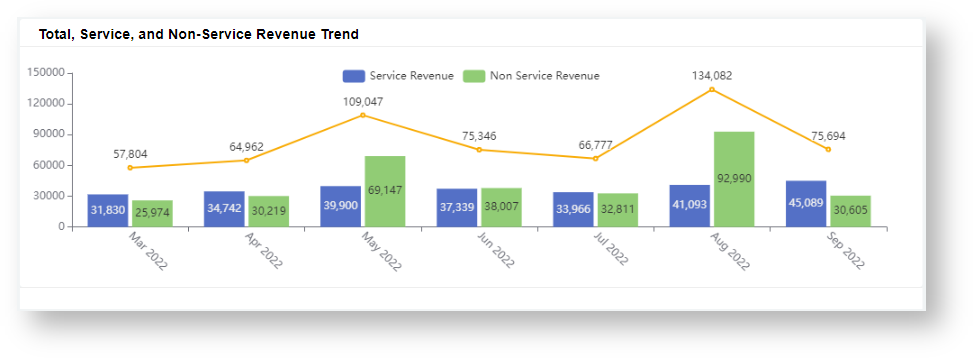

Total, Service, and Non-Service Revenue Trend

Total, Service, and Non-Service Revenue Trend is a mixed chart displaying a column chart for Service and Non-Service Revenues and a line chart for Total Revenue. The data shown in this chart is for the last 6 months.

Data source: Xero P&L (SLI-Mapped) - for Services One Time Revenue, Monthly Recurring

Revenue per Endpoint Trend

Revenue per Endpoint Trend is a bar graph and a table that shows the ratio of Revenue and number of Endpoints for the last 6 months. It uses the formula Total Revenue / Total Count of Endpoints.

Data sources:

- Xero P&L (SLI-Mapped) - for Revenue

- MSP Finance Endpoints Form (MSPbots App) - for Count of Endpoints

Avg. Billable Professional Compensation

Avg. Billable Professional Compensation is a table and a line graph showing the Average Compensation per Billable Professional for the last 6 months. It uses the formula (Direct Wages + PAYE) / Count of Billable Professionals

*NOTE: This chart uses Direct Wages in the calculation because PAYE in the dataset is 0.

Data sources:

- Xero P&L (SLI-Mapped) - for Direct Wages, PAYE

- Teams - for Count of Billable Professionals

Service Revenue per Billable Professional

The Service Revenue per Billable Professional widget is a table and a line graph showing the average Service Revenue generated per Billable Professional for the last 6 months. It uses the formula Total Service Revenue / Count of Billable Professional.

Data sources:

- Xero P&L (SLI-Mapped) - for Services One Time Revenue, Monthly Recurring

- Teams - for Count of Billable Professionals

Service Revenue to Direct Wages

Service Revenue to Direct Wages is a mixed chart and a table showing the Service Revenue, Direct Wages, and their ratio for the last 6 months. It uses the formula Service Revenue / (Direct Wages + PAYE).

Data source: Xero P&L (SLI-Mapped) - for MRR Revenue, Services One Time Revenue, Direct Wages, PAYE

MSP Finance Team Financial Benchmarking Dashboards

The MSP Finance Team Financial Benchmarking Dashboards measure your company's metric up to a set of SLI-based benchmark values to see where the metric compares over a certain period(s). For each metric, your company's performance is shown alongside the MSP benchmarking categories Bottom 1/4, Average or Median, and Best in Class (BIC) Average. You can filter these dashboards by date range and drill through most widgets to view more details and breakdowns.

Read more about SLI and MSP Finance Team Financial Benchmarking in How are the metrics and benchmarks calculated?

MSPF Benchmark - Gross Margin generated per $1 Sales

This card number shows the overall Gross Margin generated per $1 of Sales & Marketing Expenses for the selected date range. It uses the formula (Total Revenue - Total COGS) / Total Sales & Marketing Expenses.

Data source: Xero P&L (SLI-Mapped) - for Revenue, COGS, Sales & Marketing Expenses

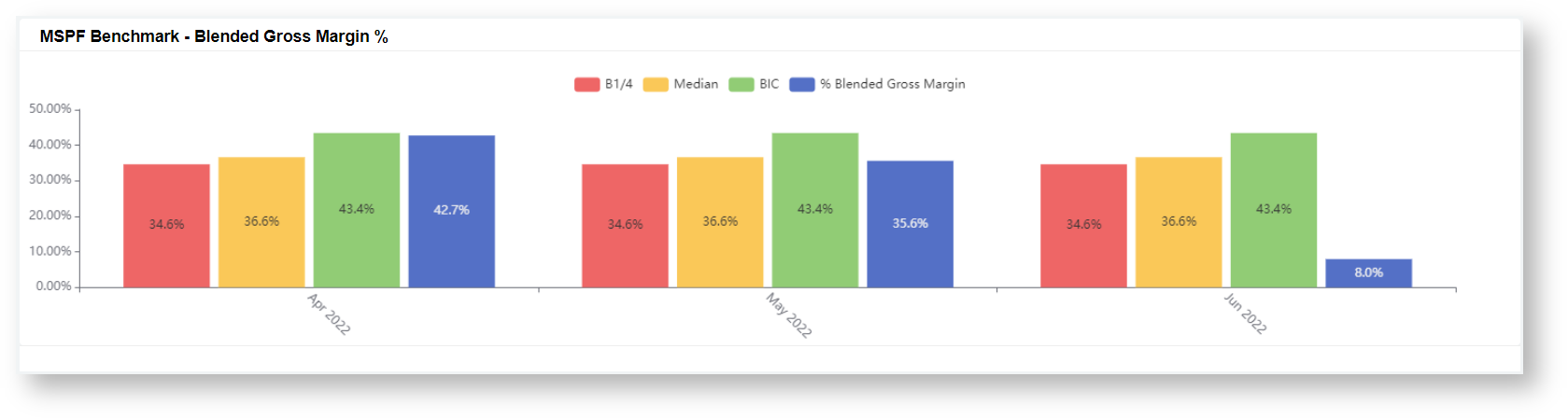

MSPF Benchmark - Blended Gross Margin %

This bar graph provides a benchmark for Gross Margin and shows monthly data for the selected date range. It uses the formula (Total Revenue - Total COGS) / Total Revenue.

Data source: Xero P&L (SLI-Mapped) - for Revenue, COGS

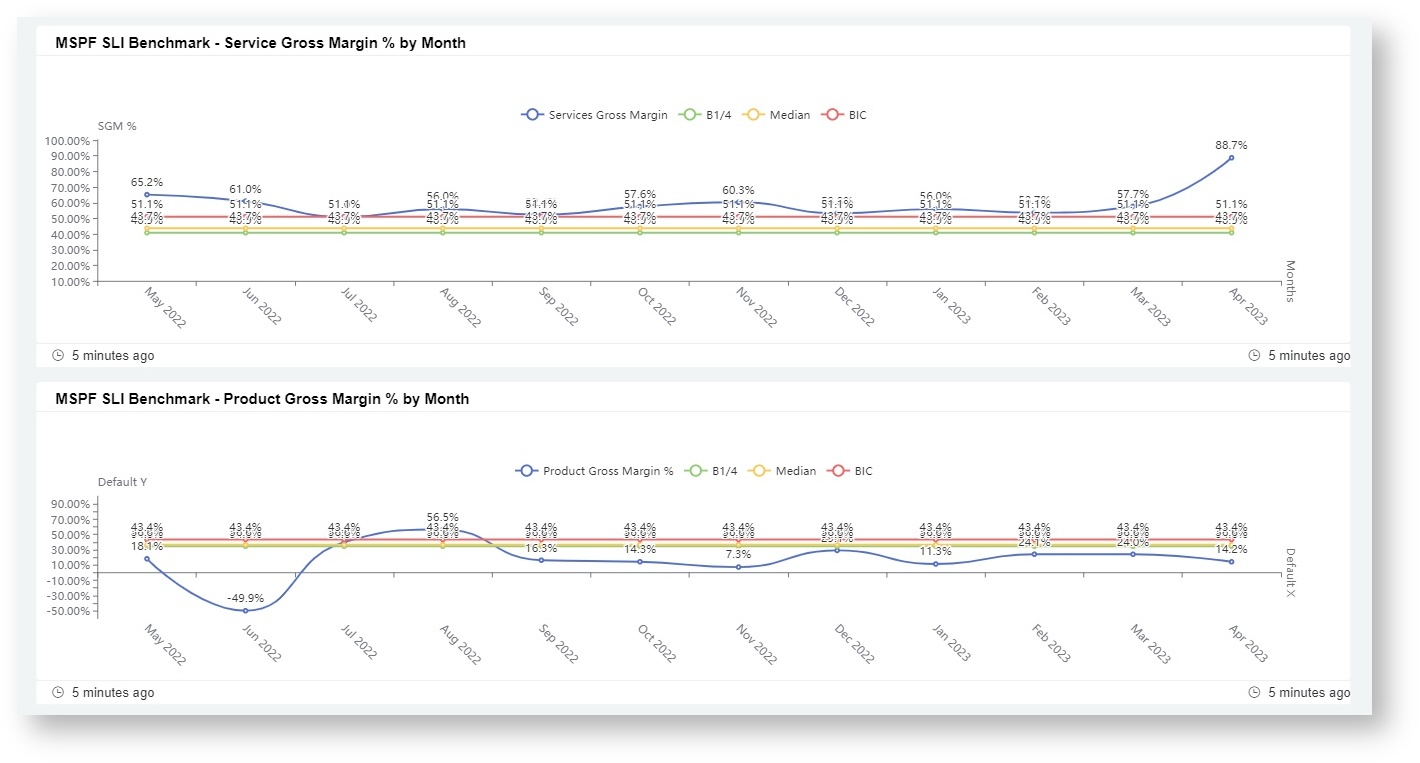

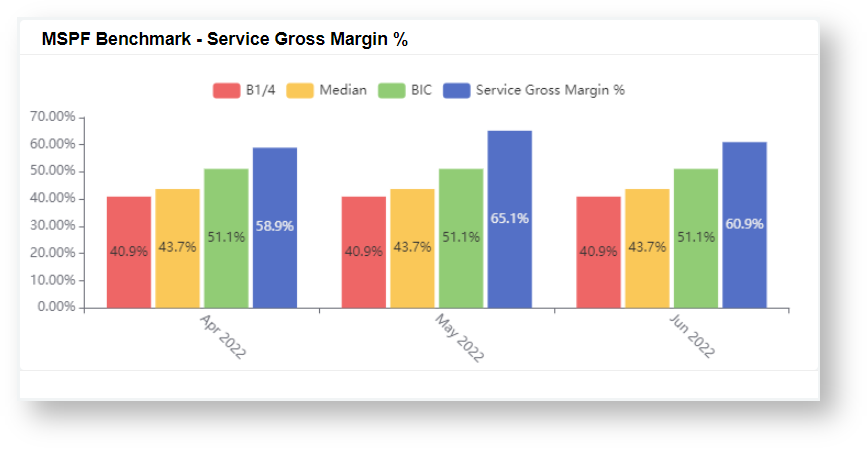

MSPF Benchmark - Service Gross Margin %

This bar graph provides a benchmark for Gross Margin and shows monthly data for the selected date range. It uses the formula (Service Revenue - Services COGS) / Service Revenue.

Data source: Xero P&L (SLI-Mapped) - for Service Revenue, Service COGS

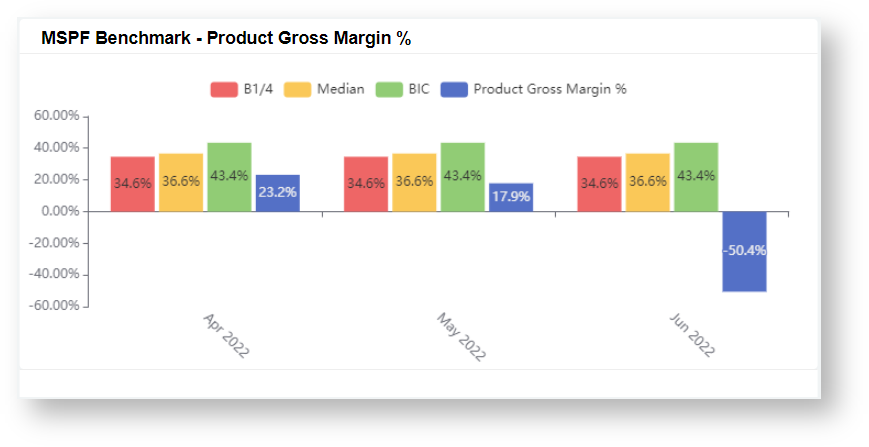

MSPF Benchmark - Product Gross Margin %

This bar graph provides a benchmark for Product Gross Margin and shows monthly data for the selected date range. It uses the formula (Product Revenue - Product COGS) / Product Revenue.

Data source: Xero P&L (SLI-Mapped) - for Product Revenue, Product COGS

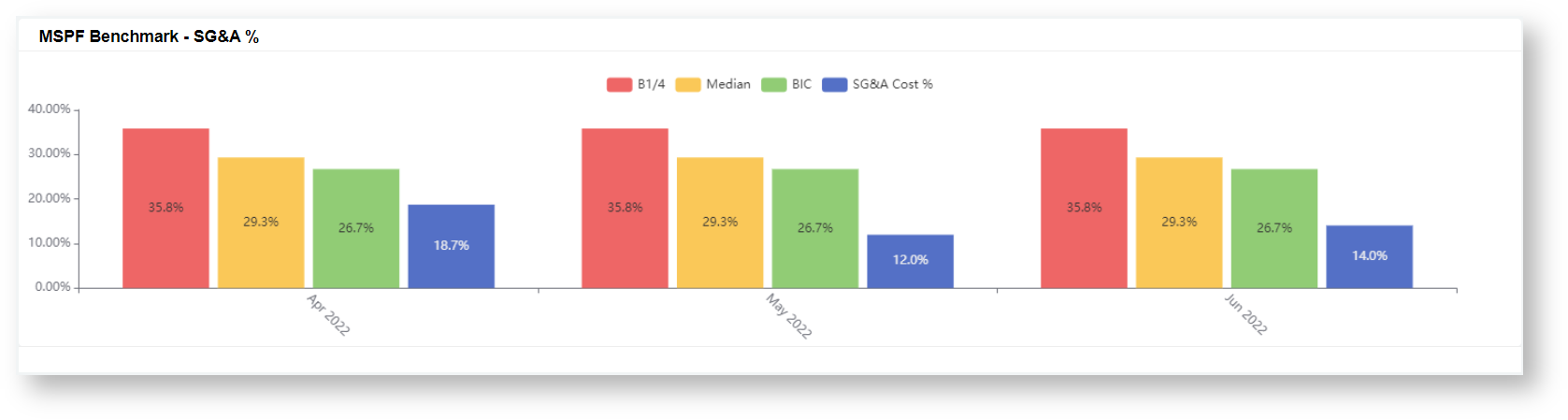

MSPF Benchmark - SG&A %

This bar graph provides a benchmark for Selling, General, and Administrative Expenses (SG&A) as a % of Total Expenses and shows monthly data for the selected date range. It uses the formula SG&A Expenses/ Total Expenses.

Data source: Xero P&L (SLI-Mapped) - for SG&A Expenses, Total Expenses

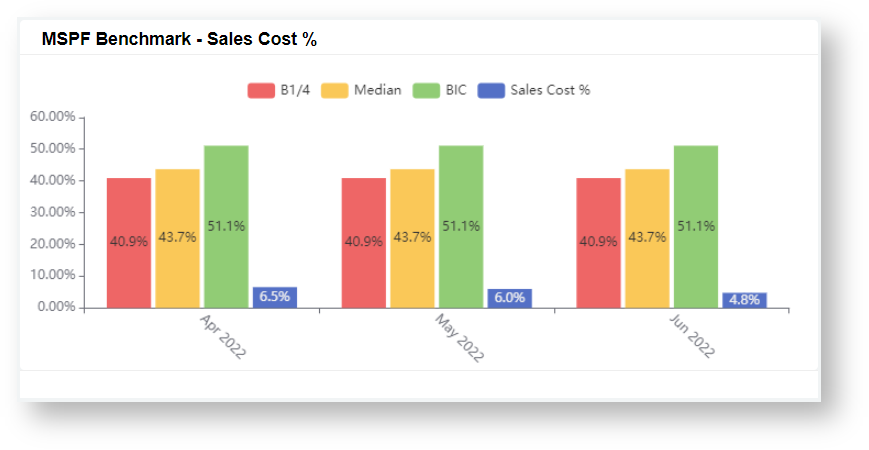

MSPF Benchmark - Sales Cost %

This bar graph provides a benchmark for Sales Expenses as a % of Total Expenses and shows monthly data for the selected date range. It uses the formula Sales Expenses / Total Expenses.

Data source: Xero P&L (SLI-Mapped) - for Sales Expenses, Total Expenses

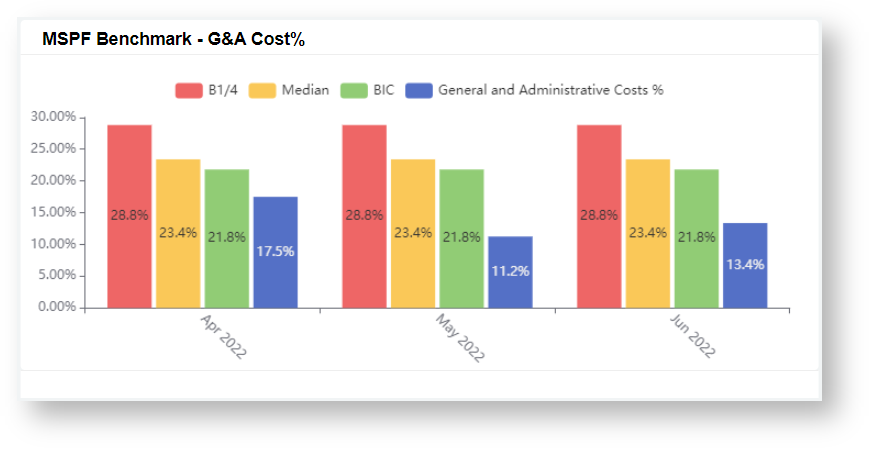

MSPF Benchmark - G&A Cost%

This bar graph provides a benchmark for General and Admin Expenses as a % of Total Expenses and shows monthly data for the selected date range. It uses the formula General and Admin Expenses / Total Expenses.

Data source: Xero P&L (SLI-Mapped) - for General and Admin Expenses, Total Expenses

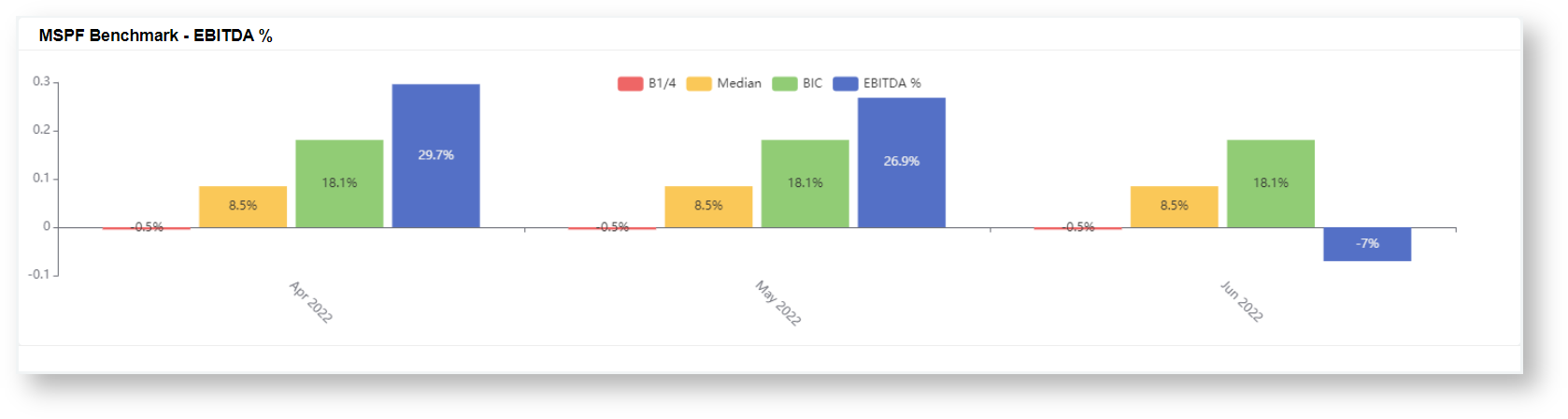

MSPF Benchmark - EBITDA %

This bar graph provides a benchmark for Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) as a % of Total Revenue. It shows monthly data for the selected date range and uses the formula (Revenue - Expense) / Total Revenue.

Data source: Xero P&L (SLI-Mapped) - for Expenses, Revenue