N O T I C E

N O T I C E

MSPbots WIKI is moving to a new home at support.mspbots.ai![]() to give you the best experience in browsing our Knowledge Base resources and addressing your concerns. Click here

to give you the best experience in browsing our Knowledge Base resources and addressing your concerns. Click here![]() for more info!

for more info!

Page History

The MSP Finance Team Financial Forecasting app enables users to make informed decisions on resource allocation, investments, budgeting, risk management, and strategic planning. By analyzing historical data, trends, and seasonality, you can plot potential future outcomes and inform decision-makers of the direction of the company's finances.

This article discusses how the calculation for the following about MSP Finance Team Financial Forecasting is done.:

| Table of Contents |

|---|

Background and Methodology

...

The MSP Finance Team Financial Forecasting app of MSPbots uses Overall Trends and Seasonality to calculate values for forecasting. The following example of a For example, the following seasonality graph illustrates how it is possible to forecast the high price seasonality of commodities corn and soy, where abundant supply during the fall harvest period results in lower prices. This Based on the values in the graph, this period reaches its peak during the summer months.

...

C. With Cyclical and Seasonal Variations D D. With Cyclical and Seasonal Variations and Random fluctuations

...

Figures C and D add Seasonal and Random value movements to the trend.

How

...

Actual Gross Margin, Revenue, and Expenses are

...

calculated

...

MSPbots uses a Machine Learning model to automatically calculate and detect Overall Trends and Seasonality.

To This model uses the following methods to forecast values, this model uses:

- Autoregressive Technique - This technique assumes that a set of time series data is dependent on its past values and there is a linear relationship between the current value and its past data. Autoregressive models are used in financial and stock market forecasts and economic modeling.

- Fournier Fourier Method - This is a method of forecasting which is designed to improve the accuracy of time series forecasting by incorporating a more flexible prior distribution for the trend component. This facilitates more complex and non-linear trends in time series data. This method also incorporates additional parameters to factor in seasonality and is widely used as a forecasting method in industries such as finance, retail, and manufacturing.

Because we apply the Machine Learning model, the forecasted values get better as more data becomes available for calculation and analysis. Ideally, data from one to two years is sufficient to achieve an acceptable level of accuracy and error margin.

What forecasts are available in the MSP Finance Financial Team Forecasting app?

...

Below are examples of forecasts available in the app.

- Gross Margin Forecast

...

- Forecast

Gross Margin is calculated as (Total Revenue - Total COGS) / Total Revenue. Although Revenue and COGS (cost of goods sold) can be modeled separately, we use the calculated value and run it using our model. As of posting,

...

- the graph below shows an average 93% accuracy

...

- measured by the variance (yellow line) between forecast and actual

...

- values over 3 months using sample data.

...

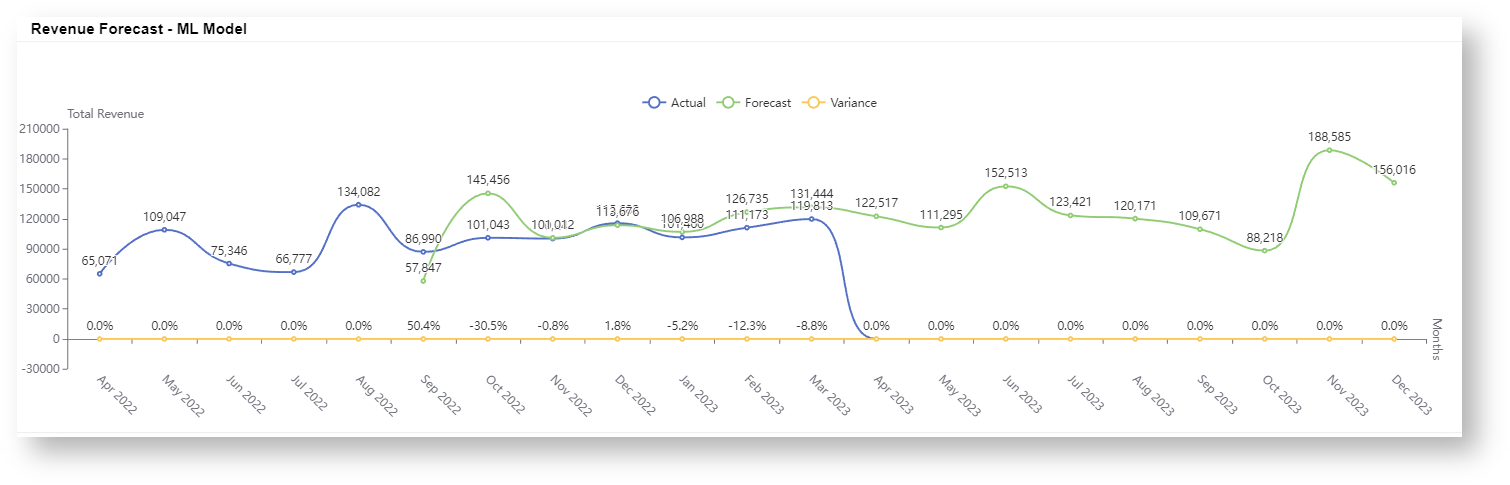

- Revenue Forecast

...

- The sample data below plots an average accuracy rate of 84.3% for the

...

- overall trend captured

...

- over seven months and shows a dip from

...

- December 2022 to January 2023.

| Content by Label | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

The calculations for this Model is run based on an open-source code granted through this license Jan 2023 as an example.